By Ram Dahal (ram.dahal@wisconsin.gov), DNR Forest Economist, Forest Product Services

Wisconsin’s forest industry creates $24 billion of products each year. Historically, more than $1 billion of that total has included products sold internationally. However, did you know that in most years, Wisconsin imports forest products of an even greater value from international sellers?

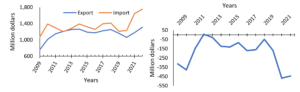

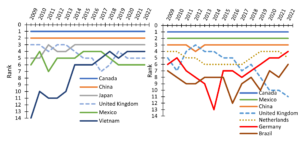

Wisconsin’s international trade balance deficit exceeded $300 million in 2009, immediately following the Great Recession, but the deficit declined until 2012. In fact, Wisconsin had a trade surplus in 2012 but quickly resumed importing more forestry commodities than it was exporting (Fig. 1).

Figure 1: Wisconsin forest products foreign import export trend (left) and trade balance (right). / Source: U.S. Census Bureau

Forest Products Import And Export Trends

In 2022, Wisconsin imported around $1.8 billion of forest products from foreign countries and exported around $1.3 billion, creating a trade deficit of more than $400 million. The result was Wisconsin’s largest international trade balance deficit in the past decade.

The import and export of forest products involves the trade of various goods derived from forests, including timber, wood products, paper products and other related forestry items. These products are essential commodities in global trade and contribute significantly to many countries’ economies.

The import and export of forest products provide wide-ranging benefits, including job creation, support to local economies, support to the construction industry and optimum resource utilization.

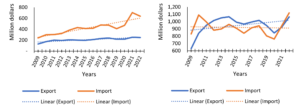

Wisconsin has always imported wood products more than it exported (Fig. 2). Wisconsin imports increased by more than 70% in 2021 compared to 2019. During the same year, exports grew by only 15%.

Wisconsin’s wood products trade deficit has grown annually because the state has more imports than exports. However, Wisconsin had a trade surplus in paper products from 2011 until 2020. The state then had a paper-products trade deficit of $15 million in 2021, which increased to $55 million in 2022 (Fig. 2).

The COVID-19 pandemic and the closure of the Park Falls Pulp and Paper and Verso mills impacted Wisconsin’s paper industry in varying degrees from 2019 to 2022.

Figure 2. Wisconsin’s wood products (left) and paper products (right) foreign import export trend. / Source: U.S. Census Bureau

Wisconsin Export Trends

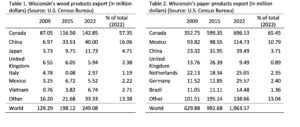

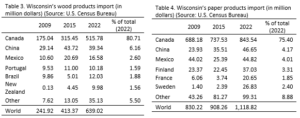

Canada has always been the leading importer of wood and paper products from Wisconsin (Fig. 3). Annually, more than 55% of Wisconsin’s wood-product exports and more than 60% of its paper-product exports go to Canada.

In 2022, Wisconsin exported more than $140 million worth of wood products (57.35% of total wood-product exports) and around $700 million worth of paper products (65.45% of total paper-product exports) to Canada (Tables 1 and 2).

China is the second-largest importer of Wisconsin’s wood products. In 2019, China imported more than $70 million of wood products, but that decreased to $40 million in 2022. Japan ranked third in importing Wisconsin wood products in 2022. Vietnam skyrocketed from No. 14 in 2009, importing less than $1 million, to No. 4 in 2022, importing more than $2.5 million.

Mexico is the second-largest importer of Wisconsin’s paper products. Mexico imported more than $114 million of paper products in 2022, its largest shipment since 2009 (Table 2). China ranked No. 3 in importing paper products from Wisconsin.

The United Kingdom ranked No. 4 between 2014 and 2016 but moved to No. 11 in 2022, importing more than $9 million. Germany ranked No. 4 in 2022, importing more than $25 million. In 2014, Germany imported around $9 million of paper products, its lowest total since 2009. The Netherlands ranked No. 5 in importing Wisconsin paper products ($25.01 million).

Wisconsin Import Trends

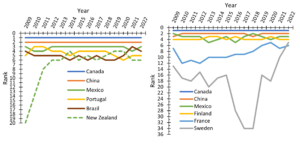

Most of Wisconsin’s wood- and paper-product imports mostly come from Canada. The import total matches more than 75% of international wood-product imports and more than 80% of global paper-product imports (Fig. 3).

Figure 3: Ranking of Wisconsin’s wood products (left) and paper products (right) foreign export trend. / Source: U.S. Census Bureau

In 2021, Wisconsin imported more than $600 million of wood products from Canada, the most since 2009 (Table 3). Similarly, Wisconsin imported about $850 million of paper products from Canada in 2022, the second-highest shipment after the Great Recession (more than $855 million in 2010).

China has been the No. 2 supplier of wood products to Wisconsin. In 2016, Wisconsin imported about $50 million of wood products from China, the largest shipment since 2009. Mexico has ranked No. 3 since 2012, except for the year 2021. Mexico accounted for around 3% of Wisconsin’s annual imports of foreign wood products.

Brazil and Portugal are other top suppliers of wood products to Wisconsin. Wisconsin imported about $125,000 of wood products from New Zealand in 2009; that increased to $10 million in 2022.

Similarly, China has been the No. 2 supplier of paper products to Wisconsin in most years. In 2010 and 2011, Wisconsin imported more than $135 million of paper products from China, its largest shipment since the Great Recession. Mexico supplied more than $95 million in paper products in the same years. During 2021 and 2022, following the COVID-19 pandemic, Wisconsin imported more than $85 million worth of paper products from China and more than $75 million from Mexico.

Together, Finland, France and Sweden supplied $135 million of paper products to Wisconsin in 2021-2022. Annually, Sweden had been supplying less than $2 million of paper products to Wisconsin, but that total grew to more than $25 million in 2022.

Wisconsin’s forest products industry is a nation’s leader and continually growing. There are abundant forest resources available in the state that can be sustainably harvested. Optimum utilization of forest resources can contribute significantly to national and international markets.

Wisconsin’s annual $1 billion of forestry-product exports represent about 4% of the state’s total exports, and Wisconsin forestry products are slowly gaining popularity in international markets. Canada and China are top destinations for Wisconsin wood products, and Canada and Mexico are leading destinations for paper products.

Figure 4: Ranking of Wisconsin’s wood products (left) and paper products (right) foreign import trend. / Source: U.S. Census Bureau