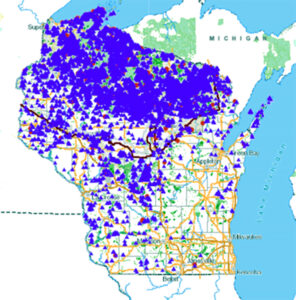

This Wisconsin overview map from Private Forest Lands Open For Public Recreation web map shows the distribution of open tax law lands (each point is a quarter-quarter section containing open land).

Fall has finally arrived in Wisconsin, although the temperatures to kick the season off certainly haven’t felt particularly autumnal. There are many blessings that fall brings, including Badger and Packer football, fall colors, apple and pumpkin pies, and of course fall hunting seasons. In the forest tax law program, we see a spike in interest for open MFL and FCL land this time of year, so it’s a timely opportunity to showcase open tax law lands.

By providing the public recreational access to their MFL or FCL lands, landowners support one of the primary purposes of Wisconsin’s Forest Tax Laws. Lands designated as open MFL provide public access for five recreational activities: hunting, fishing, hiking, sight-seeing and cross-county skiing. Lands designated as FCL allow for public hunting and fishing. Other recreational activities such as trapping and foraging are not permitted on these private open MFL and FCL lands without permission from the landowner.

Judging by the uptick in interest this time of year, deer hunting generates the most interest for open MFL lands. Landowners seeking to regenerate trees may experience additional benefits of allowing hunting on their land, as fewer deer allow more opportunities for young trees to grow.

A primary benefit to MFL landowners who open their lands to the public is reduced taxes. Open MFL status enrolled after 2004 is taxed at $1.90 per acre versus closed MFL land which is taxed at $9.49 per acre. This is in keeping with the purpose of MFL to provide public recreation access on private lands. The amount of land an owner can close to public recreation is capped at 320 acres per municipality.

To assure the public can benefit from open MFL, forest landowners must follow the requirements below:

- Provide public access on foot to the open MFL lands via one of the following:

- A contiguous public land or road

- An easement or agreement across non-public access land

- The owners’ contiguous closed or non-MFL land

- Where access is restricted to a reasonable corridor or location across non-public land, the access must be signed.

- Open MFL lands can be signed with non-permitted uses so long as permitted uses are also indicated.

- Signs must be at least 11 inches by 11 inches, conspicuous, at least 4 feet off the ground, at least two signs per quarter-mile of open land boundary (or as approved by the DNR).

- The access must be described on the MFL map.

- Owners cannot restrict the number of hunters or the time of year.

- The designation as open or closed MFL can be changed twice per 25-year enrollment period.

Seeking hunting opportunities? Recreational users can find open tax law lands through the Private Forest Lands Open for Public Recreation web mapping application.

Here are a few things to keep in mind when accessing open MFL or FCL lands:

- Recreational users don’t need to get permission to access open tax law lands but are encouraged to contact the landowner. This is especially important if the landowner lives near the site or if access is not readily apparent.

- By using the web-mapping application, recreational users can discern whether they are on MFL vs. FCL lands, which have different allowable activities.

- Changes to open or closed MFL designation occur each calendar year, effective Jan. 1. Recreational users should check to make sure properties they have visited in the past are still open.

- All hunting and fishing must follow DNR hunting and fishing seasons and regulations.

- Frequently asked questions about hunting on tax law land can be found online.

- Any access to the property other than on foot (e.g. vehicle, ATV, bike, etc.) requires landowner permission.

Landowners with open MFL and FCL lands currently contribute nearly 1 million acres of recreational opportunities to the public on actively managed lands. Please visit the Open Tax Law Lands website for more information. In particular, the “additional resources” panel has specific pages for general questions, access questions, and hunting questions.

Thank you to all the MFL and FCL landowners helping Wisconsin remain a wonderful place for the public to enjoy.