By Ram Dahal, DNR Forest Economist

Timber prices are the dollar values paid to a landowner for the right to harvest by loggers or timber buyers. Timber pricing is important as it not only defines the value of the timberland but also as a driving factor for timberland investments. Therefore, an understanding of how timber prices are set is foundational for both buyers and sellers of stumpage.

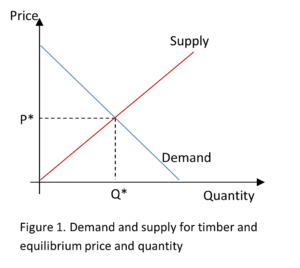

In principle, the price offered for timber depends on the interaction between the supply and demand components of a market. In the context of a timber sale, demand refers to a logger or timber buyer’s desire to purchase timber and willingness to pay for it. In most circumstances, wood-consuming mills are the primary drivers of timber demand. On the other hand, supply refers to the total amount of a timber that is available to the marketplace. Forestland owners are the primary drivers of timber supply.

The law of demand describes the inverse relationship between the quantity of goods demanded and the price. That means that with an increase in price, assuming other factors unchanged, the quantity demanded will decrease given it decreases a buyer’s affordability. On the other hand, supply describes the direct relationship between the quantity supplied and the price. That means that with the increase in price, assuming other factors remain constant, the quantity supplied will increase as it prompts the seller to supply higher quantities to the market. In timber markets, as a price increases more timberland owners will be willing to sell timber thereby increasing supply. In contrast, with increase in timber price, a mill’s willingness to purchase will decrease which decreases overall demand (or may lead to them finding alternative or cheaper sources). The condition at which quantity demanded equals quantity supplied is called equilibrium price, P* (Figure 1).

The law of demand describes the inverse relationship between the quantity of goods demanded and the price. That means that with an increase in price, assuming other factors unchanged, the quantity demanded will decrease given it decreases a buyer’s affordability. On the other hand, supply describes the direct relationship between the quantity supplied and the price. That means that with the increase in price, assuming other factors remain constant, the quantity supplied will increase as it prompts the seller to supply higher quantities to the market. In timber markets, as a price increases more timberland owners will be willing to sell timber thereby increasing supply. In contrast, with increase in timber price, a mill’s willingness to purchase will decrease which decreases overall demand (or may lead to them finding alternative or cheaper sources). The condition at which quantity demanded equals quantity supplied is called equilibrium price, P* (Figure 1).

There are number of factors impacting supply and demand and can cause each to shift upward or downward. Factors impacting demand include the cost of substitute products, housing markets, consumer tastes, quality of timber, the overall economic health, environmental policies and regulation, and energy policies. Similarly, factors affecting timber supply include timber volume, availability of markets, seasonality and weather, and tract size and accessibility.

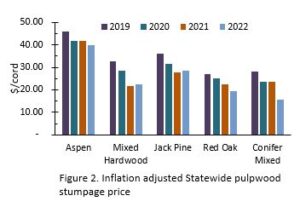

Mill closures result in a decrease in demand leading to impacts to timber pricing. For example, Verso announced its closure in 2020. The mill was one of the largest markets for the harvested timber in Wisconsin, utilizing thousands of tons of pulp per day. With the decrease in pulp demand and supply theoretically remaining constant, stumpage pricing decreased (Figure 2).

Mill closures result in a decrease in demand leading to impacts to timber pricing. For example, Verso announced its closure in 2020. The mill was one of the largest markets for the harvested timber in Wisconsin, utilizing thousands of tons of pulp per day. With the decrease in pulp demand and supply theoretically remaining constant, stumpage pricing decreased (Figure 2).

Competition is another important factor affecting timber prices. The wood basket for a mill is generally fixed (often 50-100 miles radius) but can vary depending on market conditions. Mills tend to procure wood in close proximity to lower delivery costs and often can pay higher stumpage prices. Thus, greater competition will result in higher demand and higher stumpage pricing.

Inventory is another factor impacting timber prices. Mills tend to maintain adequate inventory levels to manage costs and production. However, if inventories run low, mills may purchase on the open market and, thus, loggers may be able to pay higher stumpage prices. However, when mill inventories remain full, there are limited markets to deliver timber and, thus, this creates an oversupply in the market resulting in lower timber prices.

Log and timber supply (as standing timber) are also responsible for timber prices to change. If log supply exceeds market demand, then there will be an oversupply of potential products and pricing decreases. In contrast, when demand exceeds supply, then there will be the shortage of timber and price goes up. For example, high rates of forest conversion to non-forest land result in low timber supply to the market resulting in price increases.

Seasonality and weather also impact timber prices. During wet weather, it’s extremely difficult for loggers to harvest and deliver timber. This reduces supply of timber, often resulting in higher timber prices.

Tract size is another variable that can impact timber prices. Larger tract sizes provide opportunities for loggers to be more efficient without needing to move logging equipment from one tract to another, reducing transportation costs.

Tree size and quality also matter in timber pricing. Larger, high-quality stands of trees bring a higher price premium than smaller diameter and low-quality trees.

On a broader scale, forest policies and regulations also impact timber prices. For example, in recent decades, energy policies regarding the use of biomass, including wood, have resulted in demand growth of woody biomass. Other examples include the U.S.-Canada lumber dispute, policies that can exclude forests from timber production, and timber harvesting seasonal restrictions.

In summary, the laws of supply and demand constantly come into play when determining timber prices in the marketplace. Furthermore, the process of timber pricing is complicated, constantly changing, and is based on many pricing factors. It is, therefore, critical to examine why timber prices change and how factors affect pricing.