To protect high-value trees against infestation at Big Foot Beach State Park in Lake Geneva, a ribbon shows workers which trees to treat with herbicide or pesticide. / Photo Credit: Wisconsin DNR.

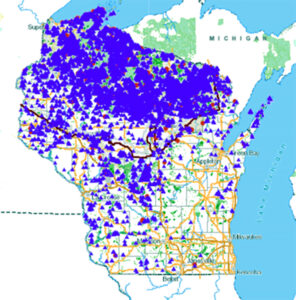

We share a desire for healthy woodlands with landowners participating in the MFL and FCL programs.

MFL and FCL management plans identify and address forest health concerns that are present or possible in your woods when the plan is written. However, the nature of these threats means they evolve over time, and new threats to forest health emerge.

Continue reading “Get The Latest On Forest Health Topics In Wisconsin”