Need funding for the conservation practices in your forest plan? Join thousands of woodland owners, many of them MFL landowners, who have secured cost-sharing from the U.S. Department of Agriculture’s Natural Resources Conservation Service (NRCS). A historic amount of funding will be made available to woodland owners through landowner assistance programs implemented by the NRCS and made possible by the Inflation Reduction Act. See more information here.

What Does This Mean For You?

This funding is a rare opportunity for MFL landowners. NRCS has identified that “shovel-ready projects identified in a Forest Management Plan are more likely to secure funding.” Examples of projects include invasive species treatment, timber marking and native tree/shrub planting (note that activities such as costs associated with building pole sheds or creating food plots are not projects that NRCS funds).

How To Get Started

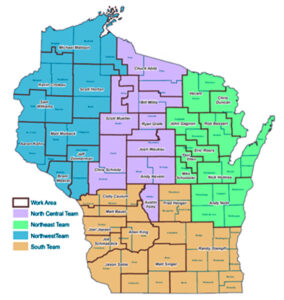

Contact your local USDA service center to learn how NRCS can help fund practices on your MFL property and help you accomplish your forest management objectives. Be sure to contact the service center for the county where your property is located, and please be patient with the NRCS staff. The increased funding is driving increased demand at NRCS field offices.

.